Crypto Trading Pairs. How do they work?

Crypto pairs are a combination of two assets that can be traded with each other on a cryptocurrency exchange. They are crucial for determining one cryptocurrency's exchange rate to another and for advanced trading strategies like arbitrage. Understanding cryptocurrency trading pairs is essential for buying specific cryptocurrencies or engaging in complex trading maneuvers. By knowing how to trade crypto pairs, traders can make informed decisions about which currencies to buy and sell and maximize their profits in the volatile world of cryptocurrencies.

What are Crypto Pairs?

Crypto pairs refer to two cryptocurrencies that are traded with each other on a cryptocurrency exchange. For example, Bitcoin and Ethereum can be traded together as a pair. Cryptocurrency pairs are used to determine the exchange rate of one cryptocurrency to another, and traders can use them to speculate on the relative value of the two currencies. The value of a crypto trading pair is typically expressed in terms of how much of one cryptocurrency is required to buy one unit of the other cryptocurrency. Understanding it is essential for anyone looking to trade cryptocurrencies on an exchange.

Crypto pairs provide a means to compare the value of different cryptocurrencies. By pairing two cryptocurrencies together, it becomes possible to determine the exchange rate between them and gauge their relative worth. This allows traders to make informed decisions based on cryptocurrency market data about buying and selling different crypto assets based on their current values.

Most exchanges offer various pairing options, which enables traders to choose a pairing based on the currencies they already possess. For instance, if a trader holds Bitcoin, they can select any pairing that includes Bitcoin on the exchange.

What functions do crypto trading pairs have?

Crypto pairs serve several vital functions in the world of cryptocurrency trading. Some essential functions include:

Comparison of values: Crypto trading pairs allow traders to compare the value of different cryptocurrencies and determine the exchange rate between them. This enables traders to make informed decisions about buying and selling specific cryptocurrencies based on their relative worth.

Liquidity: Pairs increase the liquidity of the cryptocurrency market by enabling traders to buy and sell cryptocurrencies more efficiently. By providing a means to exchange one cryptocurrency for another, crypto pairs create more opportunities for trading and investment.

Trading Flexibility: By offering various pairing options, exchanges provide traders greater flexibility in trading strategies. Traders can select pairing options based on their existing holdings, which allows them to trade more efficiently and take advantage of market opportunities.

Arbitrage opportunities: Cryptocurrency trading pairs create opportunities for arbitrage trading, in which traders can profit from price differences between exchanges or trading pairs. This type of trading requires a deep understanding of the cryptocurrency market and can be very lucrative for experienced traders.

Trading pairs are a crucial component of the cryptocurrency market, enabling traders to compare values, increase liquidity, and create a more dynamic and flexible trading environment.

How do crypto trading pairs work?

Crypto trading pairs work by pairing two cryptocurrencies together and enabling traders to exchange one cryptocurrency for another. Trading pairs are typically denoted using the symbol "/". For example, the trading pair BTC/ETH refers to the exchange rate of Ethereum in Bitcoin.

When trading cryptocurrencies, a trader might buy or sell one cryptocurrency in exchange for another at a specified price. The market supply and demand for each cryptocurrency in the pair determines this price. The value of a crypto trading pair fluctuates based on changes in the market prices of the underlying cryptocurrencies.

For example, if the price of Bitcoin increases relative to Ethereum, the value of the BTC/ETH pair would increase, meaning that more Ethereum is required to buy one Bitcoin. Conversely, if the price of Ethereum increases relative to Bitcoin, the value of the BTC/ETH pair would decrease, meaning that less Ethereum is required to buy one Bitcoin.

Exchanges typically offer multiple cryptocurrency trading pairs, which enables traders to select pairing options based on their existing holdings and trading strategies. They play a critical role in the cryptocurrency market by providing a means to compare values, increase liquidity, and offer trading flexibility.

How to trade Crypto Pairs?

Trading crypto pairs involves buying or selling one cryptocurrency in exchange for another at a specified price. Here are some steps to follow when trading it:

- Choose a cryptocurrency exchange: Select a reputable cryptocurrency exchange that offers the pairing options you want to trade. Researching and deciding on an exchange with a good track record, low fees, and high trading volume is essential.

- Create an account: Register with the chosen cryptocurrency exchange at the platform, and complete any necessary identity verification procedures.

- Deposit funds: Add funds to your exchange account by depositing cryptocurrencies or fiat currency, depending on the exchange's accepted payment methods.

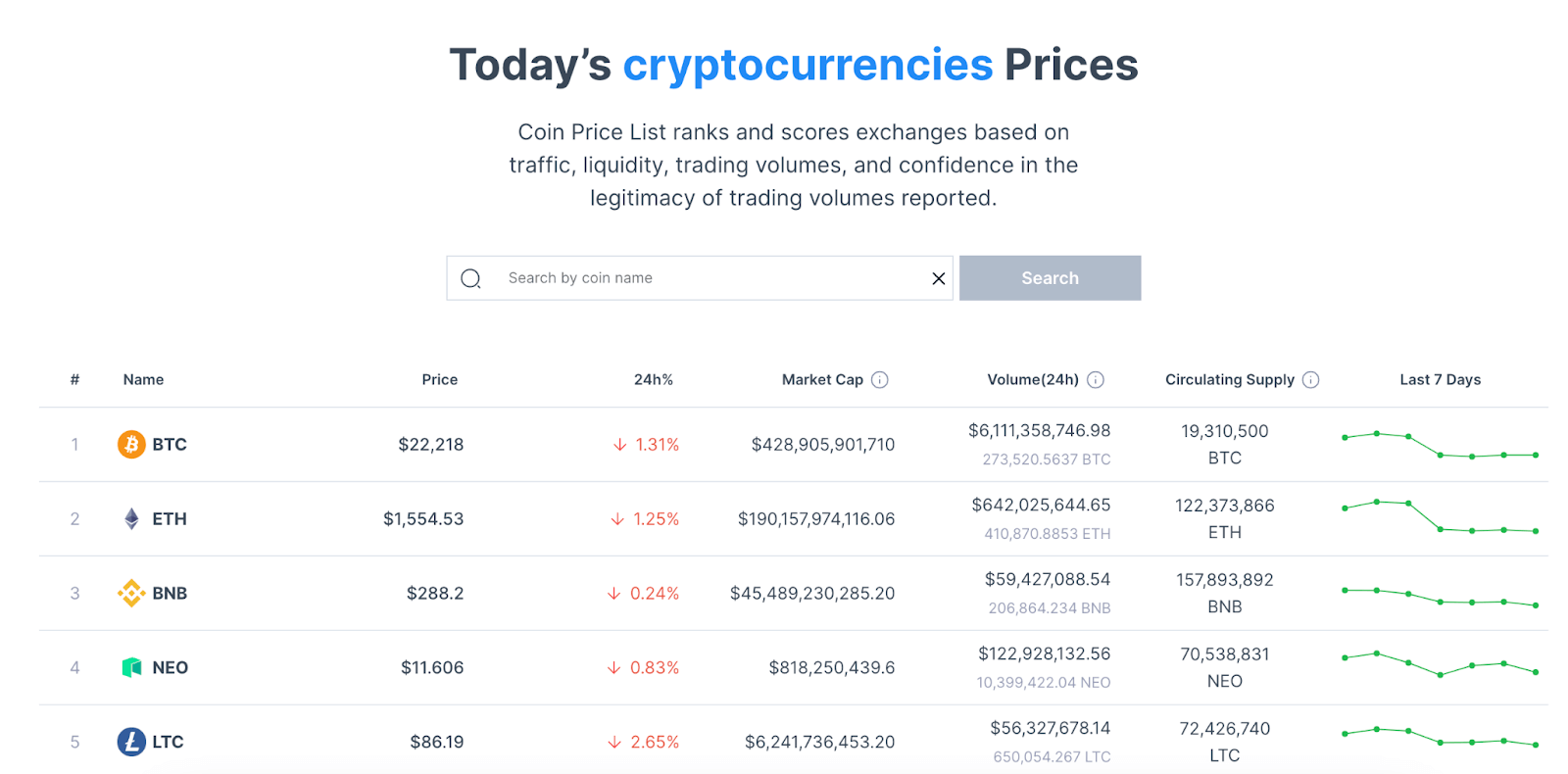

- Select a trading pair: Choose the one you want to trade based on your trading strategy, market analysis, and personal preferences. Read more about statistical data on crypto pairs here.

- Place an order: Place an order to buy or sell the selected trading pair. You can choose from different order types, such as market orders or limit orders, depending on your desired execution strategy.

- Monitor the trade: Keep track of the trade as it progresses, and adjust your strategy as needed based on market conditions or new information.

- Withdraw profits: Once your trade is complete, you can withdraw any profits by converting the cryptocurrencies into fiat currency or transferring them to a wallet.

It's important to note that trading crypto pairs can be risky due to the high volatility of the cryptocurrency market. It's essential to research, has a solid trading strategy, and manage your risk carefully to minimize potential losses.

Recent posts

Crypto Staking or Crypto Mining: Making the Right Choice

Gain a deeper understanding of staking and mining now. Explore the benefits, drawbacks, and risks associated with both methods, helping you navigate the dynamic crypto landscape.

31/08/2023

How Can Dune Analytics Highlight Shilling Activity?

Uncover 'shilling' in crypto using Dune Analytics. Understand how Dune helps users tackle shilling. Stay one step ahead with reliable data Coin Price List.

12/07/2023