What Is Shilling? What is Shilling's impact on the Crypto Market?

It is worth noting that the realm of crypto has transcended the boundaries set by Bitcoin and has engendered many captivating advancements. Fascinating developments, such as novel categories of digital assets and decentralized finance services, are manifesting within the crypto realm.

Perhaps you've encountered individuals proclaiming the arrival of the "best cryptocurrency" and urging you to invest promptly to capitalize on an imminent price surge. If so, you have likely come across a scenario involving crypto shilling. This discussion will delve into shilling and explore the precautions you should take to safeguard your funds.

What Does Shilling Mean in Crypto?

With the rise of crypto trading in the mainstream, advertisements for digital currencies have evolved from mere website banners to elaborate television campaigns. Social media influencers contribute to the buzz by publicly endorsing specific coins, often disguising their paid promotion as genuine enthusiasm.

The shilling urban dictionary refers to the aggressive promotion of a cryptocurrency, especially on social media platforms. Typically, individuals or groups shill to boost a coin's price or perceived value. While seemingly straightforward, this definition of crypto shilling carries a spectrum of implications for the cryptocurrency market and its participants.

The objective of shill crypto is to encourage investors to flock to a particular cryptocurrency, driving up demand and causing a price surge. While traditional financial markets have implemented regulations against shilling to safeguard investors, the crypto world still grapples with this practice.

Types of Shilling

There are primarily two types of shilling in the crypto world: paid and unpaid. Paid shilling involves individuals or groups who are compensated, often covertly, to hype a particular cryptocurrency. Conversely, the unpaid shilling is driven by individuals who promote a coin they hold, hoping to increase its price. Both forms impact market sentiment and can significantly affect a coin's value.

Here are some common examples:

Pump and Dump Schemes: This type of shilling involves artificially inflating the price of a particular cryptocurrency through extensive promotion and hype. Once the price reaches a desired level, the promoters sell off their holdings, causing the price to plummet and leaving other investors with significant losses.

Social Media Manipulation: Crypto shilling can occur through social media platforms, where individuals or groups attempt to create hype and positive sentiment around a specific cryptocurrency. They may use fake accounts or bots to spread positive information and encourage others to invest, influencing market dynamics.

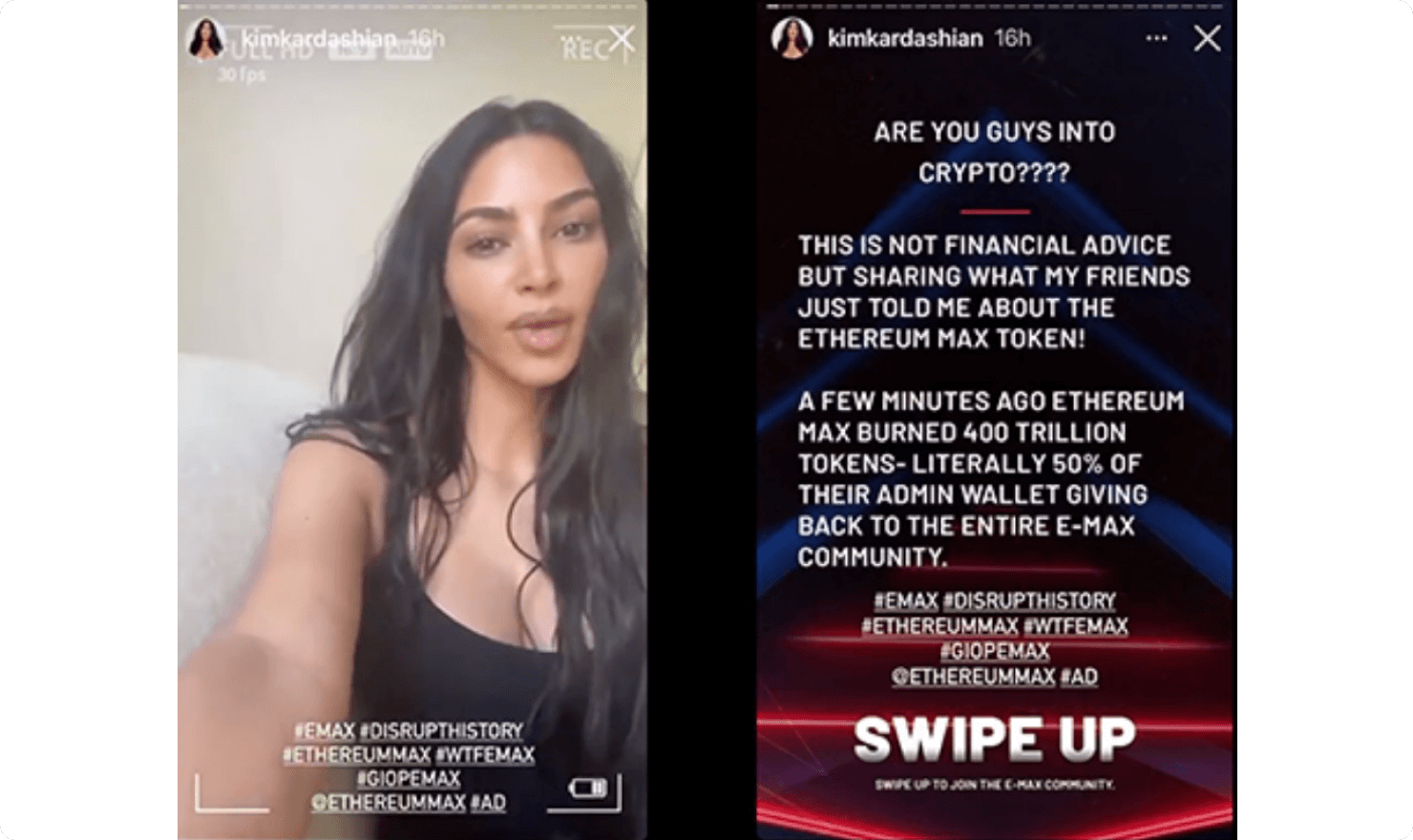

Influencer Shilling: Influencers, particularly in the crypto space, can significantly impact investor sentiment. Some influencers may promote certain cryptocurrencies without disclosing their financial interests or receiving compensation, leading to biased recommendations and potentially misleading investors.

False News and Rumors: Shilling can also spread false information or rumors about a cryptocurrency to manipulate its price. This may include fabricated partnerships, upcoming announcements, or regulatory developments to attract or repel investors.

Paid Promotions: Individuals or groups sometimes accept payment to promote a specific cryptocurrency. These promotions may occur through various channels, such as blogs, articles, YouTube videos, or sponsored content, and can create a false sense of credibility or endorsement.

It is important to note that not all promotional activities or endorsements are necessarily shilling. Genuine and transparent promotion of cryptocurrencies can also exist, where individuals share their opinions or analysis without misleading or manipulating others for personal gain.

Who Benefits From Crypto Shilling?

Crypto shilling can benefit several parties involved in the digital currency space. Here are some key beneficiaries:

Shillers

The individuals or groups engaged in crypto shilling often stand to gain the most. They aim to manipulate the market and drive up the price of a particular cryptocurrency for their financial gain. By creating hype and excitement, they may accumulate significant cryptocurrency holdings before selling at inflated prices during the ensuing price surge.

Early Investors

If the shilling creates a buying frenzy, early investors holding the promoted cryptocurrency can benefit. As the price rises due to increased demand, their existing holdings gain value. They can then sell their holdings at a profit, taking advantage of the inflated market prices.

Projects and Developers

In some cases, legitimate cryptocurrency projects may indirectly benefit from shilling activities. Positive sentiment and increased demand generated by the shilling can attract more investors and funding to the project. However, it is essential to distinguish between simple projects and those being promoted solely for manipulative purposes.

Exchanges and Trading Platforms

Increased trading activity from shilling can generate higher transaction volumes on cryptocurrency exchanges and trading platforms. This can increase revenue for these platforms through trading fees and other transaction-related charges.

It is essential to note that while some parties may benefit from crypto shilling, its practices are generally regarded as manipulative and unethical. Shilling can deceive investors, distort market dynamics, and lead to significant financial losses for unsuspecting individuals. Investors need to remain vigilant, conduct their research, and make informed decisions to protect themselves from such activities.

How does Crypto Shilling Impact the Crypto Market?

By knowing that the shill definition of crypto is a fake popularity boost, the shilling has a profound impact on the crypto market, primarily due to its potential to create market volatility. When a coin is shilled, it can create an artificial price bubble, leading to significant fluctuations in the market. This artificial inflation is often unsustainable, resulting in a boom-bust cycle that can leave unsuspecting investors at a loss.

Shilling plays a pivotal role in crypto "pump and dump" schemes. The promotion activities of shills inflate the price of a coin (the 'pump'), encouraging others to invest. Once the price peaks, they sell off their holdings (the 'dump'), leading to a drastic price decline and leaving other investors holding devalued assets.

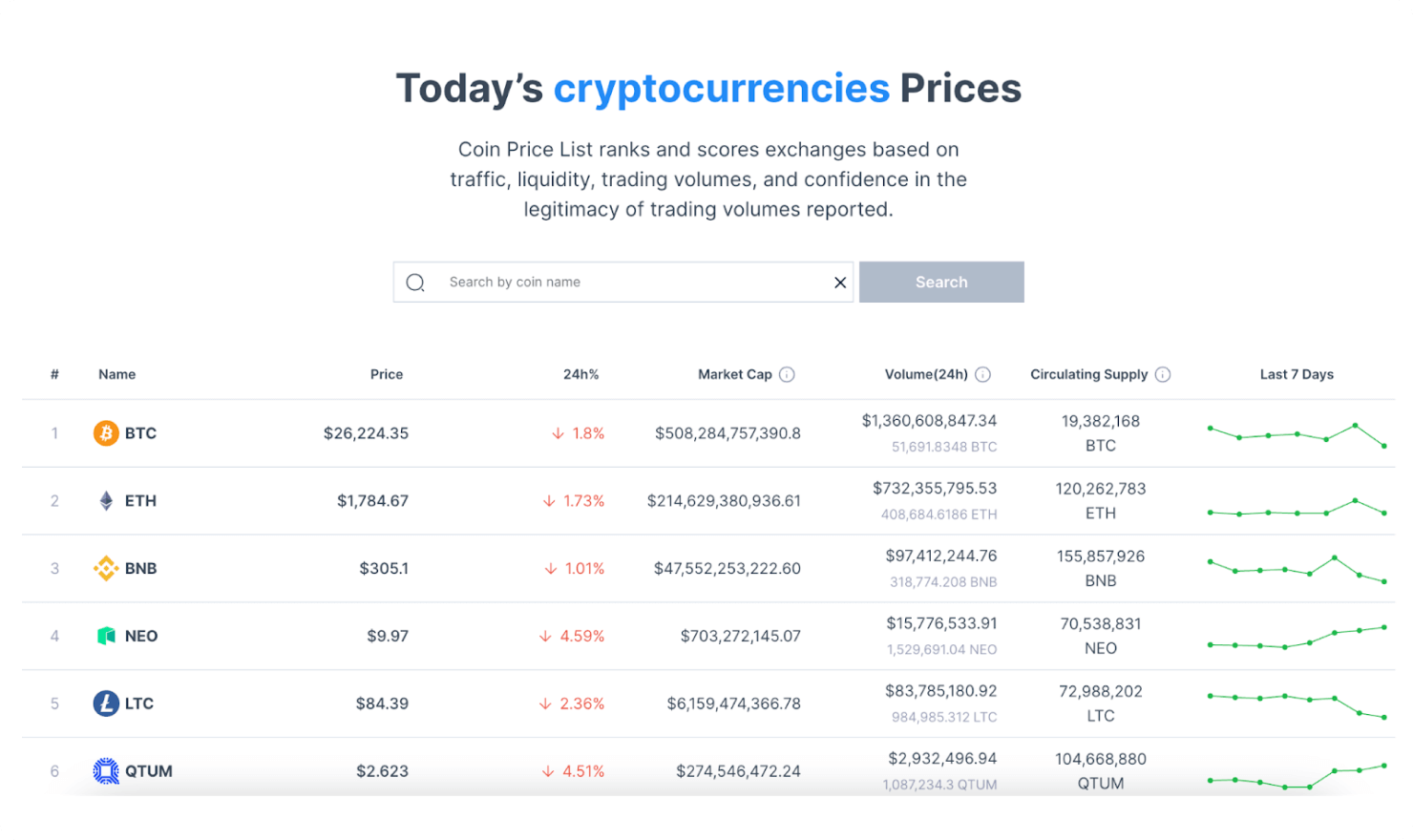

With its commitment to providing the most accurate, timely, and up-to-date market data, Coin Price List is a beacon of support in such scenarios. Its team gathers raw data from various sources to create valuable insights about cryptocurrency prices and crypto market data. With its assistance, traders can identify trends, make timely decisions, and stay updated with market dynamics.

How to Identify Shilling Crypto Definition?

Crypto shilling can be sophisticated, making it difficult to discern genuine endorsements from shilling scams. Shilling can come from influencers paid to promote the coin, enthusiastic marketers working in the shadows, or even excited founders or team members over-promoting their projects. Despite the sophisticated tactics employed by shill cryptocurrency, understanding sure signs can help identify crypto shilling scams.

A key indication of shilling is an overly enthusiastic tone about a particular coin. Shills often make unrealistic promises about potential returns. Another common trait is their limited engagement with community members, focusing solely on promoting the coin. They may have overly-specific price targets and display a conspicuous lack of transparency about their affiliations or holdings.

Tips for Recognizing a Shill Crypto

-

It's essential to differentiate genuine influencers from crypto shills in the buzzing crypto world. Shills often present the crypto they're promoting as the 'next big thing' without acknowledging its possible downsides. The first step towards this is to watch out for highly positive tones about specific crypto.

-

Shills also tend to make unrealistic promises. They may claim that the crypto they're endorsing will skyrocket in value within a brief timeframe. Such contracts should be treated with skepticism as they typically lack concrete evidence. Limited engagement with community members is another warning sign. Shills often focus on their promotional agenda, showing little interest in addressing community concerns or providing helpful insights.

-

Overly specific price targets, frequently projecting astronomical gains, can signify shilling. If the individual fails to provide a solid basis for such predictions, caution is advised. Lastly, a lack of transparency about their affiliations or investment in the promoted crypto can strongly indicate shilling. An honest influencer or promoter would be transparent about their holdings and potential conflicts of interest.

How not to become a victim of a shill?

Here are some tips to avoid falling prey to a shill and making informed decisions regarding cryptocurrency investments:

- Conduct your research (DYOR): Instead of relying solely on others' opinions, take the time to gather objective information and facts about the project. This will help you make an independent assessment of its potential.

- Assess the endorser's credibility: Look into the background and reputation of the person endorsing the project. Consider their previous involvement and expertise in the cryptocurrency space. If they are promoting a project without considering its fundamentals, exercise caution.

- Avoid impulsive decisions driven by YOLO (You Only Live Once) or FOMO (Fear Of Missing Out): Cryptocurrencies are known for their volatility, and a project's price trajectory may seem appealing, but it's crucial to recognize that corrections are likely to occur. Make rational decisions based on a thorough evaluation of the project rather than following others unthinkingly.

- Remember that fame does not guarantee factual information: Just because someone is a celebrity or has a large following does not mean they possess genuine insights or accurate information. Don't be swayed solely by their popularity; prioritize objective analysis and reliable sources of information.

By following these guidelines, you can protect yourself from falling victim to shills and make more informed choices regarding cryptocurrency investments.

Protecting Your Digital Assets

Privacy is a paramount concern in the digital age. When using any crypto platform, understanding your privacy preferences is crucial. It understands how cookies function to help users manage their digital footprint. Different types of cookies — strictly necessary, performance, functional, and targeting cookies — enable core functionalities of a website, enhance site performance, and track user behavior for targeted advertising. It's crucial to be aware of these aspects to control your online presence. As part of its broad service offering, Coin Price List ensures transparency about its privacy practices to maintain user trust.

The Right Tools for Recognizing Crypto Shilling

Having the right companion matters in understanding and navigating the tumultuous crypto waters. Through raw data from various sources, the team behind Coin Price List curates critical information about cryptocurrency market trends. With its promise of accurate, up-to-date, and timely market data, Coin Price List is just the partner you need.

In the ever-evolving world of cryptocurrency, vigilance, knowledge, and the right tools can help you steer clear of the choppy waves of shilling and come ahead. The startup-friendly platform offers plans for easy scalability, adapting to your business growth. Built by developers for developers, it provides easy integration and offers timely market data. It provides data and ensures open rates and flexibility, making it an ideal partner in your crypto journey.

Sum Up — What Is a Shilling Coin?

In conclusion, understanding the shilling and its impact on the crypto market is paramount for anyone invested in this digital realm. Shilling, while a part of the market's dynamism, can pose significant risks if not navigated wisely. However, with careful analysis and reliable tools like Coin Price List, navigating these waters can become more manageable. Whether you're a novice trader or a seasoned crypto enthusiast, staying updated on practices like shilling, recognizing their signs, and safeguarding your investments are crucial steps toward a successful crypto journey. Arm yourself with knowledge, leverage the right tools, and confidently step into the crypto world.

Recent posts

Crypto Staking or Crypto Mining: Making the Right Choice

Gain a deeper understanding of staking and mining now. Explore the benefits, drawbacks, and risks associated with both methods, helping you navigate the dynamic crypto landscape.

31/08/2023

How Can Dune Analytics Highlight Shilling Activity?

Uncover 'shilling' in crypto using Dune Analytics. Understand how Dune helps users tackle shilling. Stay one step ahead with reliable data Coin Price List.

12/07/2023