Ethereum dropping after the Merge. Why and what it means for investors and traders?

Ethereum is a decentralized platform running smart contracts. For example, applications run precisely according to a program without the possibility of fraud or third-party interference. These applications run on a blockchain, a compelling shared global infrastructure that can move value and represent property ownership. This allows developers to create markets, store registries of debts or promises, and transfer funds based on instructions given long ago (such as a will or a futures contract). And all without intermediaries or counterparty risk. The project was launched with an ether pre-sale in August 2014 by fans worldwide. It is being developed by the Ethereum Foundation, a Swiss nonprofit organization, with the participation of great minds worldwide.

Ethereum has been one of the most promising cryptocurrencies in recent years. However, after a much-anticipated merger, Ethereum's price dropped significantly. There are a few possible explanations for this. Whatever the reason, the drop in Ethereum's value will cause some concern among investors. Only time will tell if this is a temporary setback or a sign of things to come.

In this article, we talk about why Ethereum is going down. Read more next.

Why is Ethereum dropping today?

The price of Ethereum (ETH) fell after the network completed its famous, long-awaited update known as the Merger. According to analysts at Forbes, this update was intended to improve the scalability and security of the Ethereum network. However, the market does not seem to have been impressed by this news, and the price of ETH fell by 5%. Do you want to know what is going on with Ethereum? This may be because other cryptocurrencies, such as bitcoin, received kudos for their recent updates. Nevertheless, the market may reconsider the significance of this news when it has time to digest it fully. For now, however, it seems that the price of Ethereum is paying the price for failing to meet investors' expectations.

The Merge was a hard fork that split the Ethereum network into two parts, resulting in a new Ethereum chain with different rules. The old chain, Ethereum Classic (ETC), continued to operate under the old rules. The fork was necessary to modernize the Ethereum network to scale and process more transactions. However, the price of ETH plummeted after the upgrade was completed, and some investors feared that the new Ethereum network would not be able to handle the same volume of traffic as the old one.

The Ethereum network switched from the energy-intensive consensus mechanism of Proof-of-Work to the more efficient Proof-of-Stake. Under Proof-of-Stake, Ethereum validators put their ETH on the line to validate blocks and receive rewards. This transition has helped make Ethereum more scalable and sustainable over the long term. It has also made Ethereum more accessible to a broader range of users since mining requires less initial investment than mining.

Nevertheless, the value of ETH has fallen and continues to be volatile. Crypto analytics have had one question: how low will Ethereum go?

Ethereum bottom: to what level will it fall?

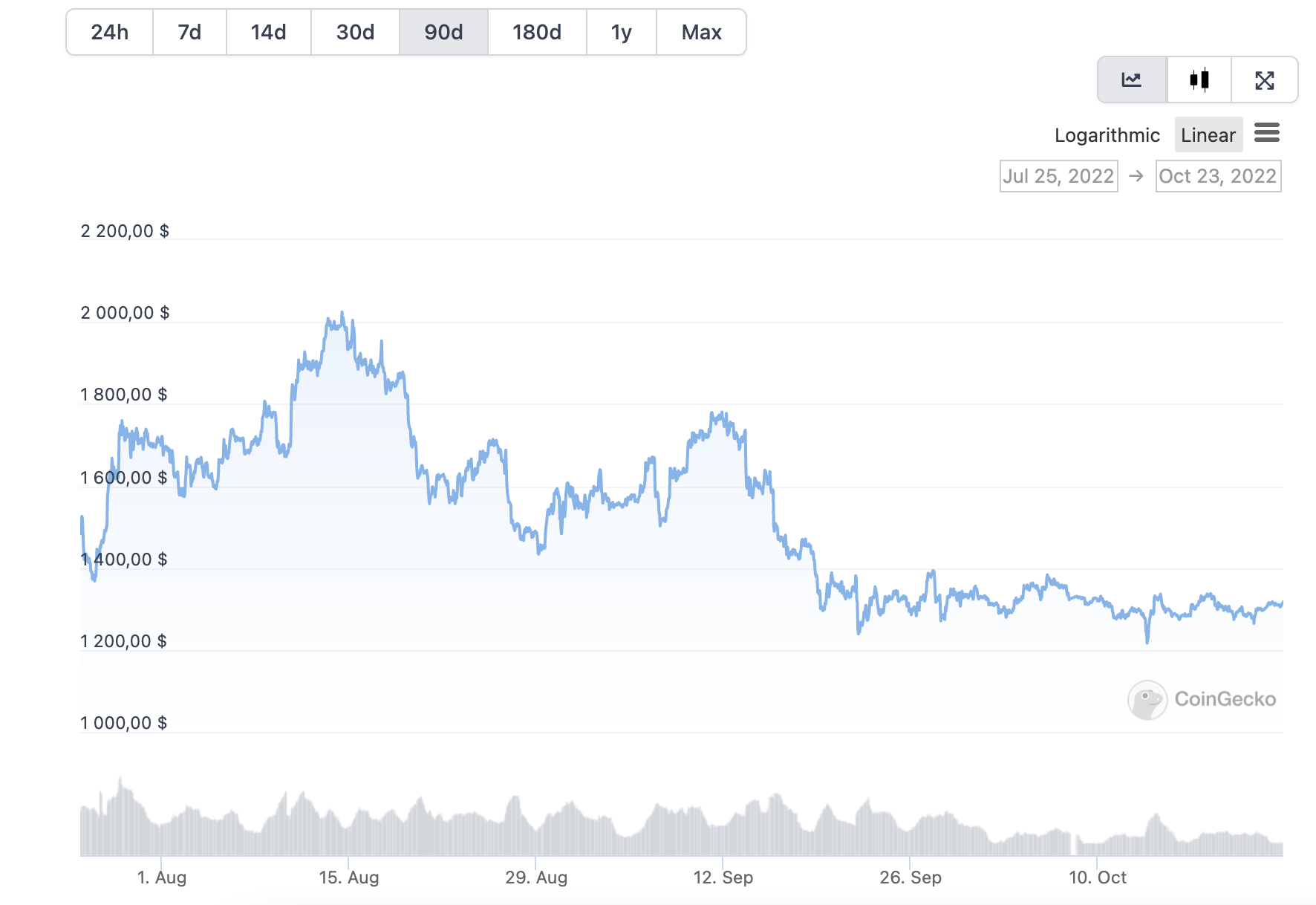

The recent drop in the price of Ethereum has many people wondering why ETH is dropping and how low the price of the cryptocurrency will fall. While it is impossible to predict the future movement of any asset, several factors could affect the price of Ethereum shortly. The price of ETH rose from $730 in late 2020 to $4,000 by May 2021, followed by another historical high of around $4,800 in November. Last, Ethereum's bottom was $880 on June 18, 2022. Since then, the cryptocurrency has gone up and down, with the most recent high of just over $2,000 reached in mid-August 2022. But that's still 58% below the all-time high reached in November 2021.

Since the long-awaited Merger was completed on September 15, the price of Ethereum has staggered. The token price has steadily declined, from more than $1,600 before the Merger to less than $1,400 after the Merger. The token's price is now around $1,300. The uncertain economy, threatening further declines, is keeping cryptocurrency prices low.

Like all cryptocurrencies, Ethereum is a high-risk investment. After an all-time high of more than $4,800 in November 2021, Ethereum has fallen nearly 69%. As a relatively new asset class, no one knows what the future holds for cryptocurrencies as an investment vehicle. Predicting their price movements is very difficult. However, Ethereum's long-term prospects remain good. Cryptocurrency is still one of the most popular and widely used blockchain platforms and continues to attract new developers and users. As the industry matures, Ethereum will likely regain its position as the leading blockchain platform. As a result, its price is also likely to rise over time. But when will Ethereum go up?

Ethereum merge price prediction: how to trade ETH now?

Unfortunately, while the Ethereum merger was a considerable development success, investors were stunned by the Ethereum price drop. Within 24 hours of the Merger, the value of ETH dropped 7.25%. The asset's relative strength (RSI) of 40.14 indicates that investors have no incentive to buy the support.

ETH, like other major coins, has been steadily declining. Ethereum's dropping in price is consistent with the overall market, which is down 2.61%. Despite the lack of post-merger Ethereum blockchain performance metrics, early signs are promising. We expect the blockchain to improve dramatically in terms of performance over time. This should encourage more developers and dApp users to acquire ETH and use it to settle transactions.

As a large-cap coin, ETH should be one of the biggest beneficiaries when the market turns bullish. It now has another catalyst to help boost its price. In addition, the improvement in the market that is expected shortly should encourage the price of ETH to rise. Overall, when ETH goes back up, $1,500 seems a good starting point, especially in the long term.

When will ETH go back up?

Once the market downturn is over, the price of Ethereum is expected to surge, The Time believes. The asset remains one of the most valuable in the market, and fundamentals derived from the Merge should drive its price even higher.

According to Changelly, the least expected price of ETH in previous years was $7,336.62, while the maximum possible price is $8,984.84. The trading expense will be around $7,606.30.

Many investors are wondering when Ethereum will rise in price. After all, the cryptocurrency has seen a slight dip in value over the past few months. However, several factors suggest that Ethereum is due for a price increase:

The number of active addresses on the Ethereum network has been steadily increasing. This suggests that more and more people are using Ethereum, which should lead to increased demand and higher prices. The Ethereum network is scheduled to undergo a significant upgrade shortly. This upgrade, known as Constantinople, is expected to improve the efficiency of the network and make it more attractive to users. Many large companies have recently announced plans to use Ethereum-based technology in their businesses. These companies include Microsoft, JPMorgan Chase, and Amazon.com. Together, these factors propose that Ethereum is poised for a price increase shortly.

Use Coinprice to keep up with developments in the cryptocurrency universe

If you're considering investing in cryptocurrencies, staying up-to-date on the latest developments is essential. Coinprice is an excellent resource for tracking crypto market data, prices, and news in the cryptocurrency universe. The site features a live price tracker for significant cryptocurrencies and an overview of market capitalization. In addition, Coinprice also provides a variety of articles and guides on topics such as mining, wallets, and trading. Whether a beginner or a seasoned investor, Coinprice is an essential resource for keeping up with the rapidly-evolving world of cryptocurrencies.

Recent posts

Crypto Staking or Crypto Mining: Making the Right Choice

Gain a deeper understanding of staking and mining now. Explore the benefits, drawbacks, and risks associated with both methods, helping you navigate the dynamic crypto landscape.

31/08/2023

How Can Dune Analytics Highlight Shilling Activity?

Uncover 'shilling' in crypto using Dune Analytics. Understand how Dune helps users tackle shilling. Stay one step ahead with reliable data Coin Price List.

12/07/2023